Type of Business Entities

The choice of entity depends on circumstance of each case and the priority and choice of Client. In first instance we suggest our clients to go for the registration of a Private Limited Company as it gives you the benefits of lesser number of compliances and it can be registered with two members and two directors which is a time and cost saving factor for the start-ups.

Every Company shall have at least one Director who has stayed in India at least 182 days or more in the previous calendar year (i.e. Resident of India_ we can assist you in making the availability of resident director as per client’s requirement)

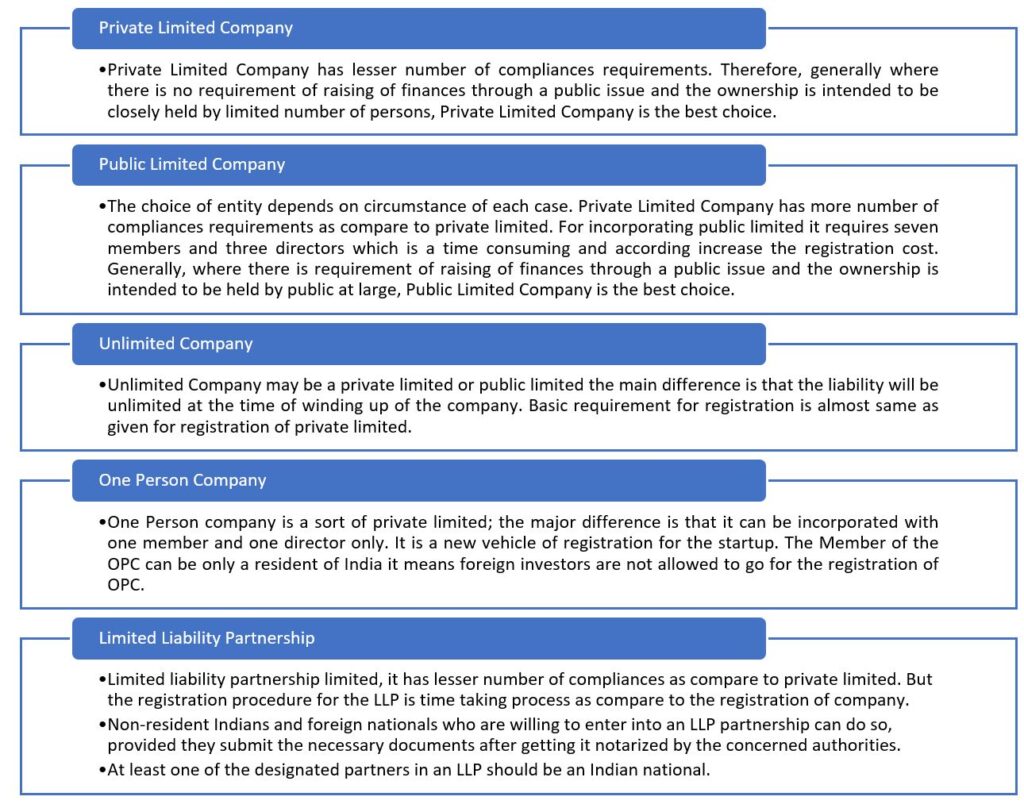

Types of Business entities available in India:

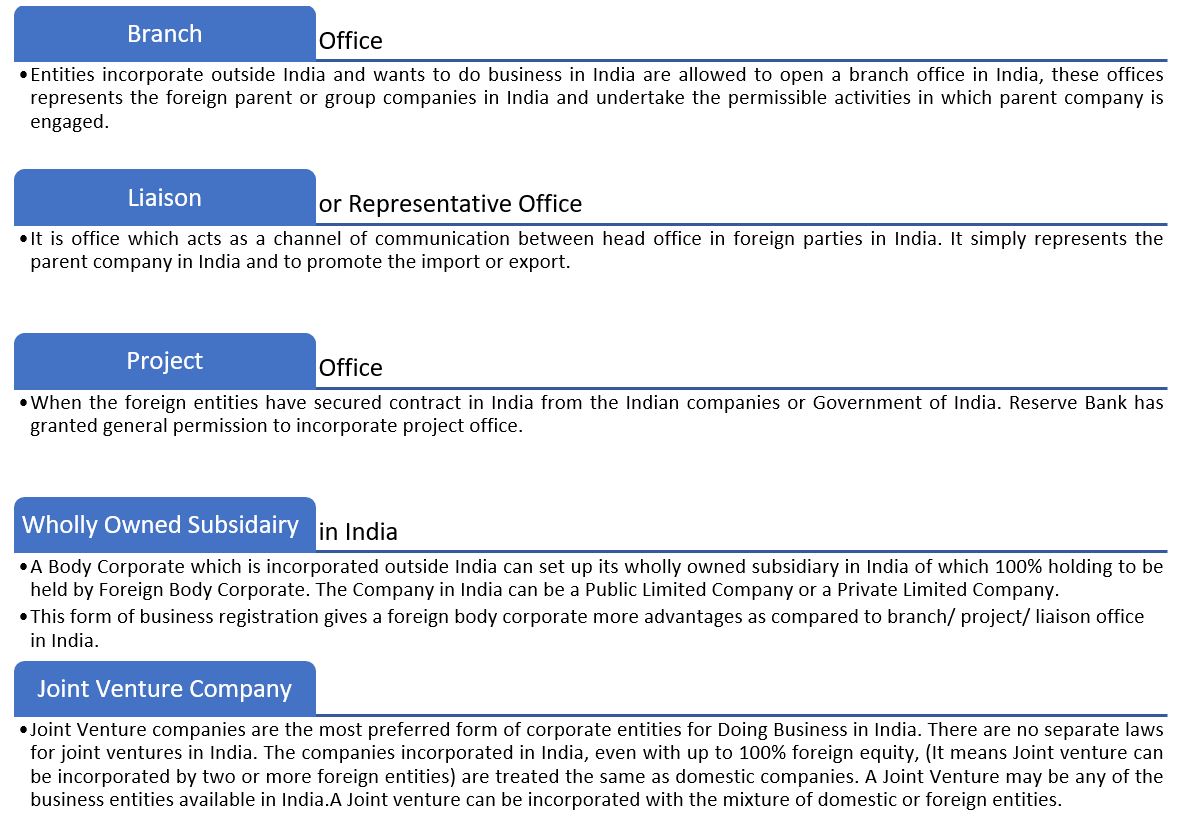

In addition to the above legal entities, the following types of entities are exclusively available for foreign investors/foreign companies doing business in India:

The procedure for incorporating Joint Venture is same as given under private limited.

Applicable laws for Incorporating in India-

Includes the companies Act, 2013 read with rules as prescribed by the central government of India Income Tax act, 1961 & other laws & regulation and Foreign Exchange Management Act, 1999 is applicable for foreign investments and transactions.