Declaration for Commencement of Business

Registration of a company is something that now you are in the process of starting your business and complying with the law of India.

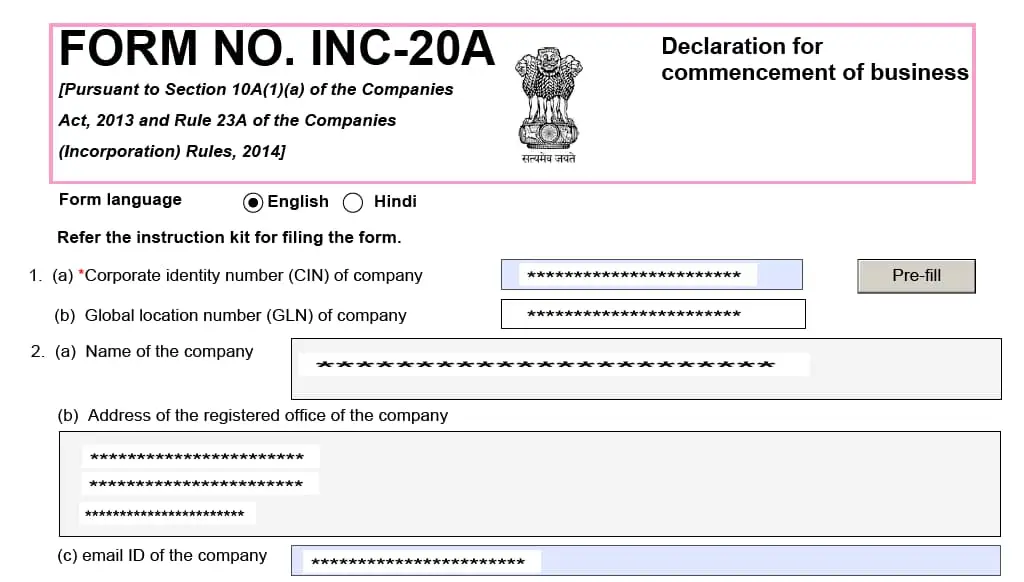

In this way, the first and most important start is that your company needs to file a declaration for commencement of business.

- This provision applies to those companies who have a share capital.

- The company shall file a declaration within a period of one hundred eighty days (180 days) of the date of incorporation of the company to the respective registrar of companies.

- The declaration shall be filed under e-form INC 20A with the registrar that every subscriber to the memorandum of association has paid the subscription money as agreed.

- Subscription money shall be received in the bank account of the company.

- A bank statement showing the transaction of subscription money shall be attached in the e-form INC 20A.

- e-form, shall be digitally signed by the authorized director of the company in the board meeting.

- e-form, shall be certified by an independent professional.

- The company shall not commence any business or exercise borrowing power without the filing of e-form INC 20A.

Any default made by the company in complying with this requirement the company and every officer in default shall be liable to a penalty of fifty thousand and one thousand rupees for each day the default continues.

Post Incorporation CompliancesReporting of bringing funds to RBIObtain GST Registration